With President Trump’s recent re-election, economic analysts from sources such as Brookings Institution and Bloomberg anticipate a stronger America-centric trade policy. This shift, alongside a September inflation increase of 2.4% in the U.S., signals changes that could reshape global trade data patterns, with rising costs and evolving trade volumes affecting businesses worldwide.

As inflation increases, its effects ripple beyond U.S. borders, impacting international trade data and business strategy. In this complex landscape, businesses reliant on trade in services data and balance of trade in services must stay informed to adapt to fluctuations in import and export prices caused by new tariffs and regulations.

Key Impacts of America-Centric Trade Policies on Global Trade Data

The shift toward stronger America-centric policies is expected to influence multiple aspects of global trade:

- Higher Tariffs and Import Restrictions: Experts foresee increased tariffs, especially in technology and energy sectors. According to The Wall Street Journal, such policies are likely to reduce U.S. product competitiveness globally, shifting demand and impacting trade in services data as companies explore alternative markets.

- Revised Trade Agreements: Predicted changes to trade agreements may disrupt supply chains. Real-time global trade data and balance of trade in services data will help companies track shifts in demand and protect profit margins.

- Need for Real-Time Data Monitoring: With inflation and new trade policies adding volatility, businesses will need accurate, real time trade data to navigate shifts effectively. Reliable global trade data platforms are essential for identifying trends and mitigating risks.

Using timely, precise trade data empowers businesses to make informed decisions and build resilience in this dynamic policy environment.

Understanding U.S. Inflation Trends in 2024

Inflation isn’t just a buzzword for economists; it’s a reality that businesses must deal with daily. With the U.S. inflation rate seeing an uptick, largely due to increased production costs, energy price fluctuations, and persistent supply chain disruptions, the economic ripples are felt globally.

Key Factors Driving U.S. Inflation

- Production Costs: Higher wages and raw material shortages are pushing production costs up, driving inflation higher and affecting the balance of prices seen in global trade data.

- Energy Prices: The rising costs of fuel and energy are making goods more expensive to produce and ship, influencing the balance of trade in services as well as in goods.

- Supply Chain Disruptions: Post pandemic inefficiencies continue to hinder smooth trade flows, contributing to inflationary pressure and reshaping the trade in services data landscape.

What makes U.S. inflation particularly important for international trade data is its direct impact on global import/export prices and subsequent trade decisions. Businesses must rely on precise and timely global trade data to navigate these fluctuations effectively.

How U.S. Inflation Affects Global Trade Data

When inflation rises, so do the costs of goods and services, both domestically and internationally. For businesses engaged in international trade, this can mean significant changes in profitability and trading volume.

Inflation’s Impact on Import and Export Prices

Inflation drives up the price of U.S. goods, making them less competitive on the global market. Conversely, as the dollar strengthens, U.S. importers may benefit from cheaper foreign goods, at least temporarily. This delicate balance can drastically alter global trade data, creating shifts in trade patterns that may not have been foreseen just a few months ago.

Impact on Trade Volume

With inflation increasing costs, many businesses may reduce their trading activities due to declining purchasing power, creating a contraction in trade volume. This will be reflected in global trade data, which may show a slowdown in certain sectors, particularly those that rely heavily on U.S. imports and exports.

Volatility in Trade Data Reports

Inflation introduces uncertainty into markets, making it harder to predict future trends. Businesses will need to rely more heavily on real time global trade data to track shifts and adjust their strategies accordingly. Without accurate, real-time data, companies risk missing timely adjustments to pricing strategies and identifying target markets, which are essential for informed decision-making and protecting profitability.

The Role of Global Trade Data in Navigating Inflation Challenges

Having access to reliable and up to date global trade data is more critical than ever in 2024. But what is global trade data, and why does it matter?

Global trade data provides insights into the movement of goods and services between countries. It allows businesses to analyse trends in trade volumes, compare trade balances, and forecast future movements based on historical data.

How Accurate Trade Data Helps Businesses Manage Inflation

In an inflation driven economy, international trade data helps businesses:

- Monitor shifting trade patterns: As inflation alters the competitiveness of U.S. exports and the cost of imports, accurate trade data can help identify new opportunities or emerging risks.

- Make informed pricing decisions: Analysing data on trade in goods and balance of trade in services, businesses can adjust pricing strategies to account for inflationary trends.

- Forecast trade volumes: Real-time trade data allows businesses to predict how inflation may affect future trade volumes, enabling them to adapt their supply chains and inventory management accordingly.

TradeData.Pro: Your Ultimate Solution for Navigating U.S. Inflation in Global Trade

In the face of inflation driven uncertainties, businesses need a robust, comprehensive tool that provides reliable global trade data. That’s where TradeData.Pro comes in. As the world’s leading trade data platform, TradeData.Pro offers unparalleled insights into international trade data, enabling businesses to stay ahead of inflationary challenges.

Why Choose TradeData.Pro

TradeData.Pro stands out from the competition by offering:

- The largest and most accurate database of global trade data, covering over 100 countries.

- Real time updates on import/export trends, helping businesses track inflationary impacts immediately.

- Detailed insights into balance of trade in services and trade in goods and services data, ensuring you have the complete picture.

- Customised reports tailored to your industry and regional focus, allowing you to hone in on inflation affected markets with precision.

How It Works

- Intuitive Interface: With an easy to use platform, TradeData.Pro provides access to both current and historical data, enabling comprehensive trend analysis.

- Custom Reporting: Generate reports that are specifically designed to highlight inflation’s impact on your trade activities. Focus on the regions or sectors that matter most to your business.

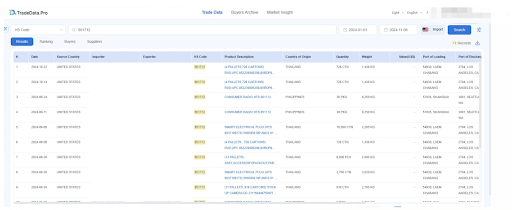

- Industry Specific Solutions: If you are in manufacturing, agriculture, or services, TradeData.Pro delivers insights that can be customised to meet your unique needs. For example, by using HS Code 851712 (telephone set) in TradeData.Pro’s database, you may view the latest trade details for this product imported into the United States.

The platform provides comprehensive data, including information on importers and exporters (with specific company names masked for confidentiality), quantities such as 728 cartons, weights, and detailed logistics data like ports of loading and discharge. This level of detail enables businesses to track market trends, identify key players, and make informed, data-driven decisions tailored to their industry needs.

Benefits of Using TradeData.Pro

- Informed Decision Making: Empower your business with data-driven insights that guide pricing, trade strategies, and supply chain optimisation.

- Competitive Advantage: Stay ahead of competitors by making the right moves in response to inflationary pressures.

- Risk Mitigation: With real time global trade data, you can reduce risks by predicting how inflation will affect different markets and adjusting your strategy in real time.

How U.S. Inflation Shapes Future Trade Policies and Data Trends

Inflation not only affects the immediate trade volume but also has long term implications for trade policies and global trade dynamics.

Impact on International Trade Agreements

As inflation alters the balance of trade, it also affects trade negotiations. Countries may push for agreements that protect their industries from the effects of U.S. inflation, such as tariffs or new trade regulations.

Shifts in the Balance of Trade in Services

With inflation making U.S. services more expensive, many countries may start seeking alternative service providers, which could shift the balance of trade in services globally.

Future Outlook for Trade Data Trends

Experts predict that inflation could lead to new patterns in global trade. Emerging markets, in particular, may experience higher volatility as they grapple with both domestic inflation and the impact of U.S. inflation on their trade in goods and services.

U.S. Inflation and America-Centric Trade Policies: Impact on Global Trade Data

With President Trump’s recent re-election, economic analysts, including those at Brookings Institution and Bloomberg, predict a stronger America-centric trade policy, potentially reshaping global trade data patterns. Businesses relying on international trade data will need to adapt to rising costs and shifting trade volumes due to new tariffs and stricter import regulations.

Predicted impacts on the balance of trade in services include:

- Higher Tariffs and Import Restrictions: Experts foresee heightened tariffs on imports, particularly in sectors like technology and energy. According to The Wall Street Journal, such policies are expected to make U.S. goods less competitive globally, shifting demand and influencing trade in services data as businesses look to alternative markets.

- Revised Trade Agreements: Expected changes to trade agreements may affect global supply chains. Leveraging real time global trade data, especially balance of trade in services data, will allow companies to track shifts in international demand and protect profit margins.

- Need for Real Time Data Monitoring: With inflation and new trade policies introducing volatility, businesses will need accurate, real time trade data to navigate these shifts effectively. Platforms providing reliable global trade data can be instrumental in identifying emerging trends and mitigating risks.

By using timely, precise trade data, businesses can make informed decisions, ensuring resilience amid inflation and evolving trade policies.

Key Takeaways for Businesses

To navigate the complexities of U.S. inflation in 2024, businesses should:

- Regularly monitor U.S. inflation data and understand how it impacts their trade relationship.

- Leverage real time global trade data from trusted platforms like TradeData.Pro to stay informed and agile.

- Adjust pricing and trade strategies based on inflationary trends to protect profit margins and minimise risk.

Stay Ahead of the U.S. Inflation Trends with TradeData.Pro

The right trade data is key to surviving and thriving in an inflation driven global market. TradeData.Pro provides you with the tools you need to make informed decisions, reduce risks, and stay competitive in 2024.

Contact TradeData.Pro today to start leveraging the power of accurate, real time global trade data! Don’t let inflation slow you down—get the insights you need to make smarter trade decisions and optimise your global strategies.