- Home

- Trade News

- Vietnam’s Rice Exports O ...

India’s Export Restrictions

The primary reason for Vietnam’s increased rice exports is India’s decision to impose export restrictions, particularly on non-basmati white rice. India is the world’s largest rice exporter, and its export ban has significantly reduced global rice supplies, creating a supply shortage in the market. This supply shortage has driven up global rice prices, making Vietnam’s rice more competitive and attractive to buyers.

Price Competitiveness

Vietnam’s rice prices are generally more competitive than Thailand’s. The pricing gap between Vietnamese rice and Thai rice has widened due to India’s export ban. Buyers, particularly those from rice-importing countries, are looking for cost-effective rice sources, and Vietnam’s competitive pricing has made it a preferred choice.

Production Capacity

Vietnam has a substantial rice production capacity and is known for its efficiency in rice cultivation, particularly in the Mekong Delta region. The ability to harvest multiple rice crops in a year, coupled with adaptability to changing weather conditions, has allowed Vietnam to maintain stable production and supply levels.

Market Diversification

Vietnam has actively diversified its rice export markets, reaching various countries in Asia and Africa. It has secured export contracts with countries such as the Philippines, Indonesia, Ivory Coast, Ghana, and China, among others. This diversification helps Vietnam weather market fluctuations and maintain consistent demand.

Adaptive Measures

Vietnam has implemented adaptive measures to address potential challenges, such as adverse weather conditions and saltwater intrusion. These measures include adjusting planting timing, crop rotation, and the development of resilient rice varieties, ensuring a more stable production.

In contrast, Thailand faces some challenges in the current global rice market:

Competitive Pricing

Thailand’s rice prices are generally higher than those of Vietnam. This pricing disparity can make Thai rice less attractive to buyers, especially when cost-effectiveness is a priority.

Domestic Consumption

Thailand’s domestic rice consumption is relatively high, limiting the quantity available for export. The country consumes a significant portion of its rice production domestically, reducing the volume available for export.

Market Access

Thailand has been actively seeking to expand its rice export markets, but it faces strong competition from countries like Vietnam and India. Gaining or maintaining market share can be challenging, especially in the presence of lower-priced alternatives.

Supply Chain Challenges

The sudden surge in demand and price volatility resulting from India’s export restrictions has created supply chain challenges for rice traders and exporters in Thailand. These challenges can disrupt the smooth execution of contracts and lead to uncertainties.

In summary, Vietnam’s success in rice exports amid India’s export restrictions is attributed to its competitive pricing, production capacity, market diversification, and adaptive measures. While Thailand remains a significant player in the global rice market, it faces challenges related to pricing, domestic consumption, market access, and supply chain dynamics that have affected its performance in the current market conditions.

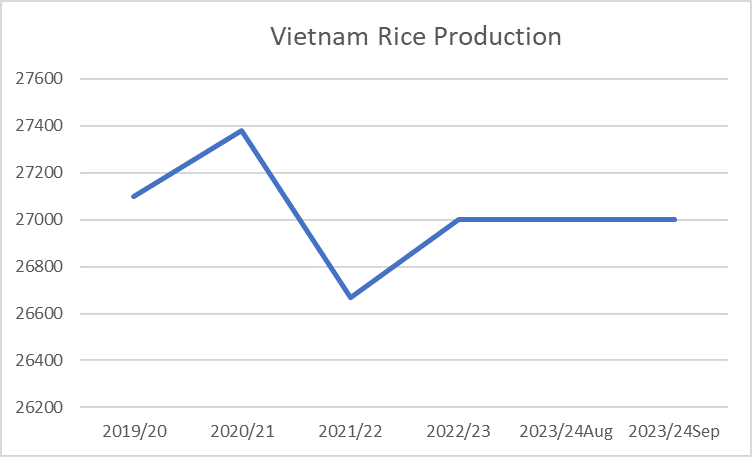

Vietnam Rice Production (in thousand metric tons):

2019/20: 27,100

2020/21: 27,381

2021/22: 26,670

2022/23: 27,000

2023/24 (August): 27,000

2023/24 (September): 27,000

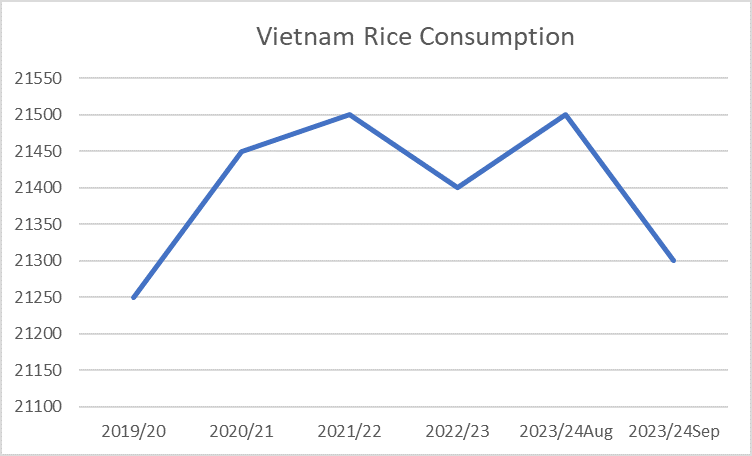

Vietnam Rice Consumption (in thousand metric tons):

2019/20: 21,250

2020/21: 21,450

2021/22: 21,500

2022/23: 21,400

2023/24 (August): 21,500

2023/24 (September): 21,300

According to the data, Vietnam’s rice production and consumption are relatively balanced, without an apparent oversupply. However, Vietnam’s ability to export a substantial quantity of rice in a short period, can be attributed to several factors:

Seasonality

Rice production is not evenly distributed throughout the year. Vietnam typically has multiple rice harvests annually, with the largest crop known as the “summer-autumn” rice harvest, often occurring between July and August. This period yields a significant surplus of rice, enabling higher export volumes.

Strong International Demand

There has been a surge in global rice prices due to various factors, including India’s export restrictions. This has led to increased demand for rice from alternative suppliers like Vietnam. Buyers in countries affected by India’s export ban are looking to secure rice from other sources, driving up demand for Vietnamese rice.

Competitive Pricing

Vietnam’s rice is often competitively priced compared to other suppliers, making it an attractive option for buyers seeking affordable rice alternatives. The price competitiveness of Vietnamese rice can lead to higher export volumes even when production and consumption are relatively balanced.

Export Contracts

Vietnamese rice exporters often secure contracts in advance, which allows them to meet the increased demand promptly. These contracts ensure a steady flow of rice exports even during periods when domestic consumption is relatively stable.

Supply Chain Efficiency

Vietnam has a well-established and efficient supply chain for rice exports. This includes infrastructure such as ports and logistics networks that facilitate the timely movement of rice to international markets.

While Vietnam may not have an oversupply of rice, its ability to respond to increased demand, especially during peak harvest seasons, coupled with competitive pricing and efficient supply chains, enables the country to export substantial quantities of rice and achieve significant growth in the value of rice exports.

Here is a chronological organization of the key events related to the rice export situation since late July:

July:

July 20 – India halts exports of its largest rice category, raising concerns about global food price inflation.

July 21 – Vietnam calls for domestic rice supply assurance following India’s export ban.

July 21 – India’s export ban results in the cancellation of contracts for around 2 million metric tons of rice.

July 27 – Rice prices from Vietnam and Thailand reach their highest levels in over a decade due to India’s export restrictions.

July 28 – India restricts exports of deoiled rice bran used in cattle feed until Nov. 30.

July 28 – The United Arab Emirates bans rice exports and re-exports for four months, including Indian-origin rice.

July 29 – The Philippines expresses concerns about its rice stocks and considers supply deals with India due to El Nino weather concerns.

August:

Aug 1 – Rice exporters in Thailand and Vietnam begin renegotiating prices for around half a million metric tons of rice for August shipment.

Aug 4 – The UN food agency’s rice price index rises 2.8% in July to its highest level in nearly 12 years.

Aug 7 – The Philippines considers extending reduced import tariffs on rice and other commodities to ease inflation.

Aug 11 – Retail prices for rice in the Philippines rise by 4% to 14% in two weeks due to global and domestic farmgate price increases.

Aug 16 – The Philippines’ Department of Agriculture recommends additional rice importation due to potential crop losses from El Nino.

Aug 16 – Vietnamese exporters renegotiate higher prices for around half a million metric tons of rice.

Aug 18 – Indian farmers increase rice planting due to monsoon rains and higher prices.

Aug 21 – Indonesia’s Bulog seeks rice imports from Cambodia and Myanmar to bolster government stocks amid El Nino concerns.

Aug 25 – Myanmar plans temporary restrictions on rice exports to control domestic prices.

Aug 25 – India imposes a 20% duty on parboiled rice exports.

Aug 27 – India sets a $1,200 per ton minimum export price for basmati rice shipments.

Aug 29 – India’s export duty on parboiled rice leads to the postponement of shipments totaling around 500,000 metric tons to after mid-October.

Aug 30 – India allows traders to export non-basmati white rice cargoes that were previously stuck at ports when the export ban was imposed.

To read more about how Vietnam’s rice industry adapts to global demand surge, click here.

The most trustable and reliable source for Trade Data.

TradeData.Pro is a reliable and trustworthy source of trade data proudly made in Singapore, a country known for its stable political climate and trade-driven economy. Presented by Commodities Intelligence Centre, a government-linked company and a joint venture of Zall Smartcom, SGX, and GeTS, TradeData.Pro has received positive feedback from the market since its launch in 2018 for its extensive coverage, affordability, and fast response. The platform has been awarded the Singapore Quality Class in 2020 and the Stevie Award Gold in 2021.

Traditionally, obtaining critical data to reveal trends, identify market opportunities, track competitors, buyers, and suppliers, and better understand the potential of the supply chain has been a challenge. However, the detailed shipment information that is part of government import and export filing requirements does exist and forms the core of global trade. TradeData.Pro has gathered and packaged this information as business intelligence, which helps companies understand the flow of goods across borders and features the world’s largest searchable trade database. TradeData.Pro reviews, standardizes, and cleans data and delivers it in an intuitive format, making it easier for businesses to access.

Businesses interested in staying updated on Vietnam, the hottest industry lately, can access all relevant information on the TradeData.Pro platform. They can find the exact product they’re interested in by checking out the trade database demo at https://tradedata.pro/asia-trade-data/vietnam-import-export-data/. To learn more about accessing new markets, visit https://tradedata.pro/trade-database-demo/.

Additionally, businesses can check out this article to learn how to use TradeData.Pro to access Global Trade Markets: https://blog.tradedata.pro/v3-new-upgrade-of-world-leading-global-trade-data-platform/. To understand how TradeData.Pro works, watch the video below or visit https://www.youtube.com/watch?v=tITfUvjs6Gc

Business Economy Export Import International Trade Markets Opportunities Rice Supplier Thailand Vietnam Worldwide

Leave a Reply Cancel reply

Recent Posts

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- April 2024

- March 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2021

Categories

Recent Post

Indonesia Exports: Sunny Outlook Despite Coal, US

- June 30, 2025

- 9 min read

Taiwan Exports: Hitting Record Highs in Challenging

- June 30, 2025

- 7 min read

Forecasting a Brighter Outlook for Chile Imports

- May 30, 2025

- 8 min read

All Tags

Agriculture Automotive Brazil Business Business Opportunities Buyers China Coffee Commodities Crops Ecommerce Economic Economy Electronics Energy Environmental Europe Export Exports Future Garments Global Import India Industries International Trade Leads Leads Generation manufacturing Markets Opportunities Pharmaceuticals Prices Rice Russia Supplier Textiles Trade Trade Data Trade Data Pro Turkey Ukraine United States Vietnam Worldwide

3 replies on “Vietnam’s Rice Exports Outshine Thailand’s”

[…] Vietnam’s Rice Exports Outshine Thailand’s: Discover how Vietnam’s rice industry i… […]

[…] Vietnam’s Rice Exports Outshine Thailand’s: Discover how Vietnam’s rice industry i… […]

[…] Stay informed about the how Vietnam outshine Thailand in rice exports here. […]