- Home

- Trade News

- Vietnam Semiconductor Industry ...

Vietnam semiconductor Industry

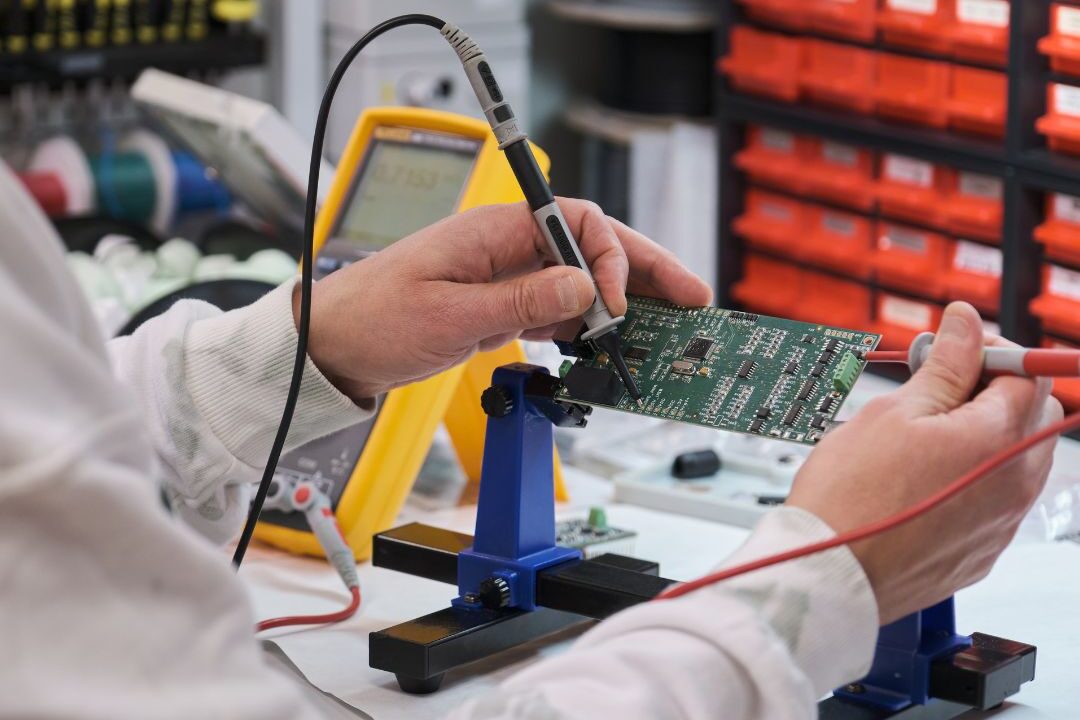

Vietnam semiconductor industry is again the latest and hottest topic of 2022, with Vietnam industry growing rapidly and gaining many interest of investors and semiconductor companies moving and thinking of developing their own manufacturing factory in Vietnam.

In a previous blogpost covered by Trade Data Pro, FPT Semiconductor unveiled its first IC chips in August 2022 for use in Internet of Things (IoT) medical devices. These chips were designed in Vietnam and produced in South Korea. Vietnam has been the hottest industry lately, to stay updated on Vietnam, you can view all these information on Vietnam in here on our platform: https://data.cic-tp.com/asia-trade-data/vietnam-import-export-data

According to recent media reports, Samsung, the largest memory chip manufacturer in the world, will start producing semiconductor parts in Vietnam in July 2023, further diversifying its manufacturing as the US, China, and other countries look to diversify and improve their supply chains for technology.

The Samsung Electro-Mechanics Vietnam factory in the northern Thai Nguyen province is where Samsung is now testing ball grid array goods with the intention of mass producing them. The South Korean behemoth earlier this year also invested an additional US$920 million in its Thai Nguyen electronic components manufacturing.

The largest foreign direct investor in Vietnam, Samsung, made the first US$1.3 billion investment in the business that makes mainboards and other electronic components in 2013. The amount increased to US$18 billion the previous year. The multinational electronics corporation also has six facilities there and is constructing a brand-new R&D facility in Hanoi, the nation’s capital.

Samsung will now enter its third industry in Vietnam, where it already produces half of its smartphones and home appliances. Find the exact product you are interested in here at https://tradedata.pro/trade-database-demo/

Samsung’s investment in Vietnam’s semiconductor business is not without rivalry, though, as reputable US-based chip software firm Synopsys revealed in August that it was expanding its presence there. With the Saigon high-tech park in Vietnam, Synopsys has previously inked an MoU to train Vietnamese electrical engineers while also distributing 30 licences for the park, valued at $20 million. This action reflects the company’s scepticism regarding the Chinese semiconductor industry in the midst of the US-China trade war as well as Vietnam’s growing appeal on the global market.

The Synopsys vice president highlighted Vietnam’s comparative advantage over other nations in the region as being the availability of young engineering talent at a lower cost. Vietnam emerges as an ideal alternative destination as the US attempts to limit the amount of shipments of chip-making tools to China, according to a Synopsys official.

Given that prior to Samsung’s entrance, other international corporations only had a few semiconductor packaging and testing operations in Vietnam, Samsung’s decision certainly has a significant impact on the nation’s semiconductor industry.

The fact that Samsung, one of the biggest names in the global electronics market, chose Vietnam and the US over Japan, Europe, or any other nation to begin producing semiconductors says a lot about Vietnam’s potential as a budding manufacturing hub and its aspirations to keep expanding in the foreseeable future.

The inclusion of the South Korean behemoth is likely to promote the growth of sectors related to semiconductors and advance the localization of the necessary skill sets and knowledge.

In the next years, Samsung will also help Vietnam in a cascading manner, since a number of new domestic companies as well as significant international players may prosper. Due to this, Vietnam would have a competitive advantage over other potential investment destinations.

Vietnam’s flourishing semiconductor industry

Vietnam Strengths

Good demographics, along with reasonably low labour costs and human resources, are Vietnam’s primary advantages in establishing the semiconductor industry. A rising ecosystem of local entrepreneurs who are eager to learn and better, an ambitious administration that is opening the country to outside commerce and investment, and clear plans for the future development paths of the nation are other strengths of Vietnam.

Additionally, the nation’s neutrality in both the Russia-Ukraine war and the US-China trade war has made it simpler for investors to pick a location to make and supply components for other economies.

Vietnam Weaknesses

Here are some of the major difficulties Vietnam may encounter as it attempts to build its semiconductor sector. With a constrained but growing budget, the administration should make sure the community’s infrastructure can support more businesses without becoming congested, restructure and simplify administrative processes, improve transparency, and keep its legal framework up to date to ensure fair competition.

At the same time, the nation should give improvement to the educational system top priority in order to make it accessible for laying the groundwork necessary for the steady advancement of regional knowledge.

What is particularly notable is that packaging and testing, the area of the semiconductor business where Vietnam is most active, has lower margins than semiconductor design and production. The primary obstacle to Vietnam moving up another rung in the value chain is really the high standards for manufacturing facilities as well as the highly skilled labour force.

Vietnam has everything it needs to enter the manufacturing sector, but it will probably take some time and depend on the political system’s ability to guide and support entrepreneurs as well as on the global macroeconomic factors that may have an impact on and reshape the global supply.

Semiconductors Key players

Prior to Samsung, Intel Products Vietnam (IPV), the biggest assembly and testing facility in Intel’s network, was located in Vietnam. Intel promised to invest $475 million last year to develop a state-of-the-art microelectronics testing and assembly facility in Vietnam. While the world was experiencing a chip crisis, IPV kept operations running smoothly and made a number of creative contributions to help address the semiconductor shortage.

One of Intel’s largest plants, the complex was constructed in Vietnam and has received more than US$1.5 billion from the powerhouse in the components business over the previous 15 years. Its direct investments are anticipated to continue for the foreseeable future given its goal of becoming the top producer of electronic components in the world.

Other chipmakers have also established research facilities and factories in Vietnam, including Qualcomm, Texas Instruments, SK Hynix, and NXP Semiconductors. These businesses have established the foundation for manufacturing, logistics, and research facilities, which has improved Vietnam’s desirability as a location for additional industry investment.

Large OEM supplier Hayward Quartz Technology received permission to build a facility in Vietnam worth US$110 million earlier this year. Once operational, the facility will produce materials for microelectronics production, including crystal silicon blocks, plastic polymers, and other materials.

One of Apple’s EMS providers, Pegatron, paid $22.9 million in the same month to purchase land in Vietnam. The company plans to invest an additional $1 billion to build up sizable production capacity in the region. Two additional Apple iPhone assemblers, Foxconn and Wistron, have plans to broaden their local reach.

Outlook of Vietnam Semiconductor Industry

It is clear that global firms are diversifying their portfolios and making investments in nations besides China, a trend that cuts across all sectors of the economy. Although most companies still desire to operate in China, the country’s zero-covid goal and closed borders have compelled them to diversify their operations to other manufacturing hubs. A good illustration of this is Samsung’s investment in Vietnam.

Vietnam would therefore continue to be a very alluring destination due to its proximity to China, minimal political risk, international integration, available tax advantages, labour cost, and demography.

Since the semiconductor business can’t be said to differ all that much from other industries, Vietnam is likely to become more competitive in this market over the next few years. Large corporations moving in, like Samsung, will also aid in building ancillary sectors that will sustain further growth and development in the nation.

To find out more about accessing a new market, you can check out this article which shows you how to use Trade Data Pro to access Global Trade Markets: https://blog.tradedata.pro/say-hello-to-our-new-release-of-tradedata-pro/

The most trustable and reliable source for Trade Data.

Since the launch of Trade Data Pro in 2018, Trade Data Pro has received overwhelmingly positive remarks from market. This is because Trade Data Pro has wide coverage, low cost, and fast response. There are many leading companies from different industries that have subscribed to Trade Data Pro .

Trade Data Pro was awarded with Singapore Quality Class in 2020 and Stevie Award Gold in 2021. Businesses need information to reveal trends, identify market opportunities, track competitors buyers and suppliers, and better understand supply chain potential.

Finding these critical data has traditionally been challenging. But this information do exist, but as part of government import and export filing requirement. The detailed shipment information which are within these filings constructions the core of the global trade.

Trade Data Pro has gathered and packaged these information as business intelligence. Our solution helps companies understand the flow of goods across borders and features the world’s largest searchable trade database. We do the heavy lifting for you by reviewing, standardising, and cleaning data, then delivering in an intuitive format.

Learn how TradeData.Pro works by watching the video below! View here on Youtube as well: https://youtu.be/QQ9wG-CesI8

The

Business Buyers Chips Commodities Economy Export Exports Global Import International Trade Markets Semiconductor USA Vietnam Worldwide

Recent Posts

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- April 2024

- March 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2021

Categories

Recent Post

Indonesia Exports: Sunny Outlook Despite Coal, US

- June 30, 2025

- 9 min read

Taiwan Exports: Hitting Record Highs in Challenging

- June 30, 2025

- 7 min read

Forecasting a Brighter Outlook for Chile Imports

- May 30, 2025

- 8 min read

All Tags

Agriculture Automotive Brazil Business Business Opportunities Buyers China Coffee Commodities Crops Ecommerce Economic Economy Electronics Energy Environmental Europe Export Exports Future Garments Global Import India Industries International Trade Leads Leads Generation manufacturing Markets Opportunities Pharmaceuticals Prices Rice Russia Supplier Textiles Trade Trade Data Trade Data Pro Turkey Ukraine United States Vietnam Worldwide