- Home

- Trade News

- Brazil’s trade surplus in 20 ...

Brazil International Trade Overview

Although Brazil is the world’s ninth-largest economy and the largest in Latin America, it has low trade penetration compared with other large economies and a small number of exporters relative to its population. Therefore, the Brazilian government has been improving trade and encouraging import and export trade.

Furthermore, Brazil has always maintained good trade relations with many countries. Among them, Brazil’s main trading partners are China, the United States, Argentina, Germany, the Netherlands, and other countries. Brazil’s continued openness to international trade and integration into the world economy is reflected in the country’s import and export trade in goods and services as a percentage of GDP, which rose sharply from 24.3% in 2017 to 39.2% due to increased imports and exports in both 2020 and 2021.

For the past few years, Brazil has generally maintained a trade surplus, which has been driven mainly due to significant exports of minerals and agricultural product such as soybeans, iron ore, and crude oil. Brazil’s trade surplus was particularly strong in 2021 and 2022, recording US$61.2 billion and US$62.3 billion respectively.

The largest trade surplus was with China, the Netherlands, Argentina, Chile, Iran and Spain, while the most significant trade deficit was with Germany, South Korea, Russia, Switzerland, Algeria and France. However, the country’s trade balance can be influenced by various factors, such as global demand for its exports, commodity prices, and exchange rates, and can therefore be subject to volatility. Read on to understand Brazil 2023 trade surplus.

Brazil Import Trade

27.5% of Brazil’s 2020 imports are machinery products that show the potential of the machinery industry

Brazil’s total imports in 2020 were US$160.39 billion and ranked 29th in global imports. China, the United States, Germany and Argentina are Brazil’s main import partners, account respectively 22.67%, 18.27%, 6.05%, and 4.78% of total imports in 2020. For more details about Brazil’s import trade, visit TradeData.Pro and get the latest organized data and information.

According to import data from Brazil, the two main imports into the country in 2020 were machinery, mechanical appliances and parts(27.4%); and chemical products (21.95%).

It is worth mentioning that the Chinese government restricted fertilizer exports in 2022 to protect the domestic market. Phosphate exports to Brazil fell by 50% between January and October 2022. Fertiliser imports accounted for 4.87% of Brazil’s total imports in 2020, so China’s move is bound to impact Brazil’s domestic market and agriculture. Read more about the impact of China’s fertilizer policy here.

Wish to get the latest statistics on Brazil imports trend? You can find more organized import data from TradeData.Pro. TradeData.Pro offers detailed customs data for Brazil that includes importer company names, HS code, product description, quantity, value, country of origin, transport type, and other information. Visit TradeData.Pro now for more detailed information.

Brazil Export Trade

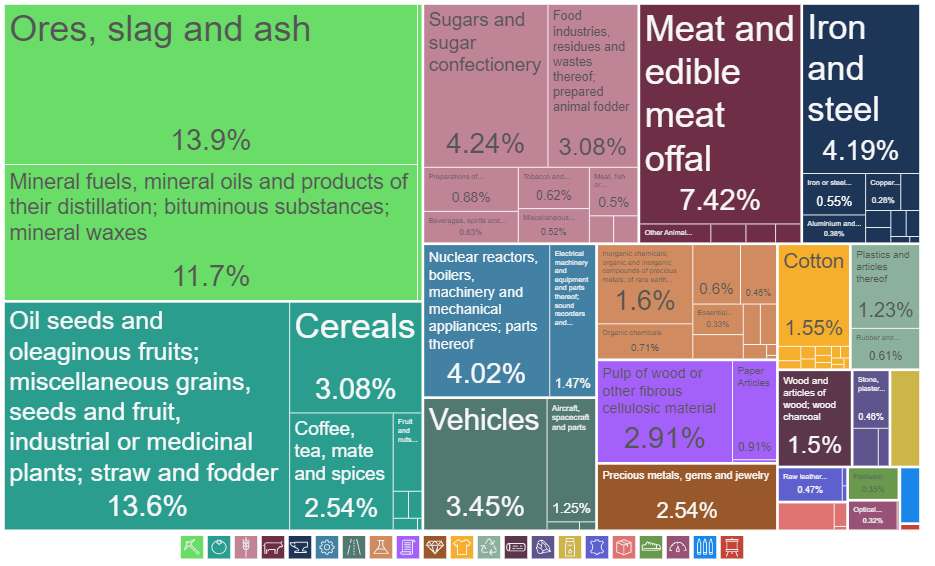

Brazil mainly exported mineral products and agricultural products in 2020

Brazil’s total exports in 2020 had a total value of US$214.40 billion, and Brazil is also ranked 25th in Exports. Brazil’s main export partners remain China, the United States, Germany and Argentina. In 2020, exports to these countries will account for 22.67%, 18.27%, 6.05% and 4.78% of the total exports, respectively.

Brazil mainly exports mineral products and agricultural products. In 2020, mineral products such as ores, slag and mineral fuels accounted for 25.6% of total exports, while oil seeds and oleaginous fruits, miscellaneous grains, seeds and fruit, cereals, tea and other vegetable products accounted for about 20% of total exports.

It’s worthwhile to mention that Brazil’s agricultural export potential. In addition to mineral exports, Brazil, a country with ample land and water reserves, still has much-uncultivated land with the potential for future agricultural production. According to USDA projections, Brazil will need to produce 76% more grains and 41% more oilseeds in 2031 than in 2021 to meet expected demand from domestic consumers as well as corn and soybean importers such as China. Suppose Brazil continues to innovate in farming practices and techniques for sustainable agriculture, develop storage facilities and transport infrastructure, and improve health controls; it will help Brazil increase the value of products sold in high-income countries and continue to grow in emerging markets. Read more about Brazil’s agriculture’s future development here.

Are you seeking the most recent data on the exports trend in Brazil? Use TradeData.Pro to get arranged export data, such as exporter name, buyer name, arrival country, sender country, HS code, product description, quantity, weight, value, and more at your fingertips! The detailed and exclusive trade data intelligence allows you to have a better comprehension of Brazilian export activity.

Brazil 2023 Trade Surplus

Brazil recorded a higher trade surplus (US$27.17 billion) in January 2023 compared to a deficit of US$58.7 million in the same month in 2022. Exports were US$423.14 billion, up 11.7% from the same period last year, with the mining industry (22.3%), agricultural industry (4.6%), and transformation industry (9.9%) leading the way. Imports, meanwhile, fell 1.7% to US$20.42 billion, mainly due to a 36.1% reduction in purchases of commodities from the extractive sector.

According to Herlon Brandão, director of Foreign Trade Intelligence and Statistics, Brazil expects a higher trade surplus in 2023 due to reduced imports, whereas exports should remain constant from 2022. He also said at the news conference that in an expected global economic slowdown, falling commodity prices should affect Brazil’s import trade, mainly affecting the country’s fuel purchases.

As a result, Brazil is expected to show a high trade surplus in 2023 and an increase compared to 2022, while exports remain at the same level and imports decline.

Keep an eye on TradeData.Pro for more international trade information about Brazil. This allows you to understand market changes and trends better, find new business opportunities, and facilitate development in your international trade.

The most trustable and reliable source for Trade Data.

TradeData.Pro is a reliable and trustworthy source of trade data proudly made in Singapore, a country known for its stable political climate and trade-driven economy. Presented by Commodities Intelligence Centre, a government-linked company and a joint venture of Zall Smartcom, SGX, and GeTS, TradeData.Pro has received positive feedback from the market since its launch in 2018 for its extensive coverage, affordability, and fast response. The platform has been awarded the Singapore Quality Class in 2020 and the Stevie Award Gold in 2021.

Traditionally, obtaining critical data to reveal trends, identify market opportunities, track competitors, buyers, and suppliers, and better understand the potential of the supply chain has been a challenge. However, the detailed shipment information that is part of government import and export filing requirements does exist and forms the core of global trade. TradeData.Pro has gathered and packaged this information as business intelligence, which helps companies understand the flow of goods across borders and features the world’s largest searchable trade database. TradeData.Pro reviews, standardizes, and cleans data and delivers it in an intuitive format, making it easier for businesses to access.

Businesses interested in staying updated on Vietnam, the hottest industry lately, can access all relevant information on the TradeData.Pro platform. They can find the exact product they’re interested in by checking out the trade database demo at https://tradedata.pro/asia-trade-data/vietnam-import-export-data/. To learn more about accessing new markets, visit https://tradedata.pro/trade-database-demo/.

Additionally, businesses can check out this article to learn how to use TradeData.Pro to access Global Trade Markets: https://blog.tradedata.pro/say-hello-to-our-new-release-of-tradedata-pro/. To understand how TradeData.Pro works, watch the video below or visit https://www.youtube.com/watch?v=tITfUvjs6Gc.

Brazil Business Economy Export Global Import International Trade Leads Markets Trade Data Pro Worldwide