- Home

- Trade News

- Brazil’s biofuel market: One ...

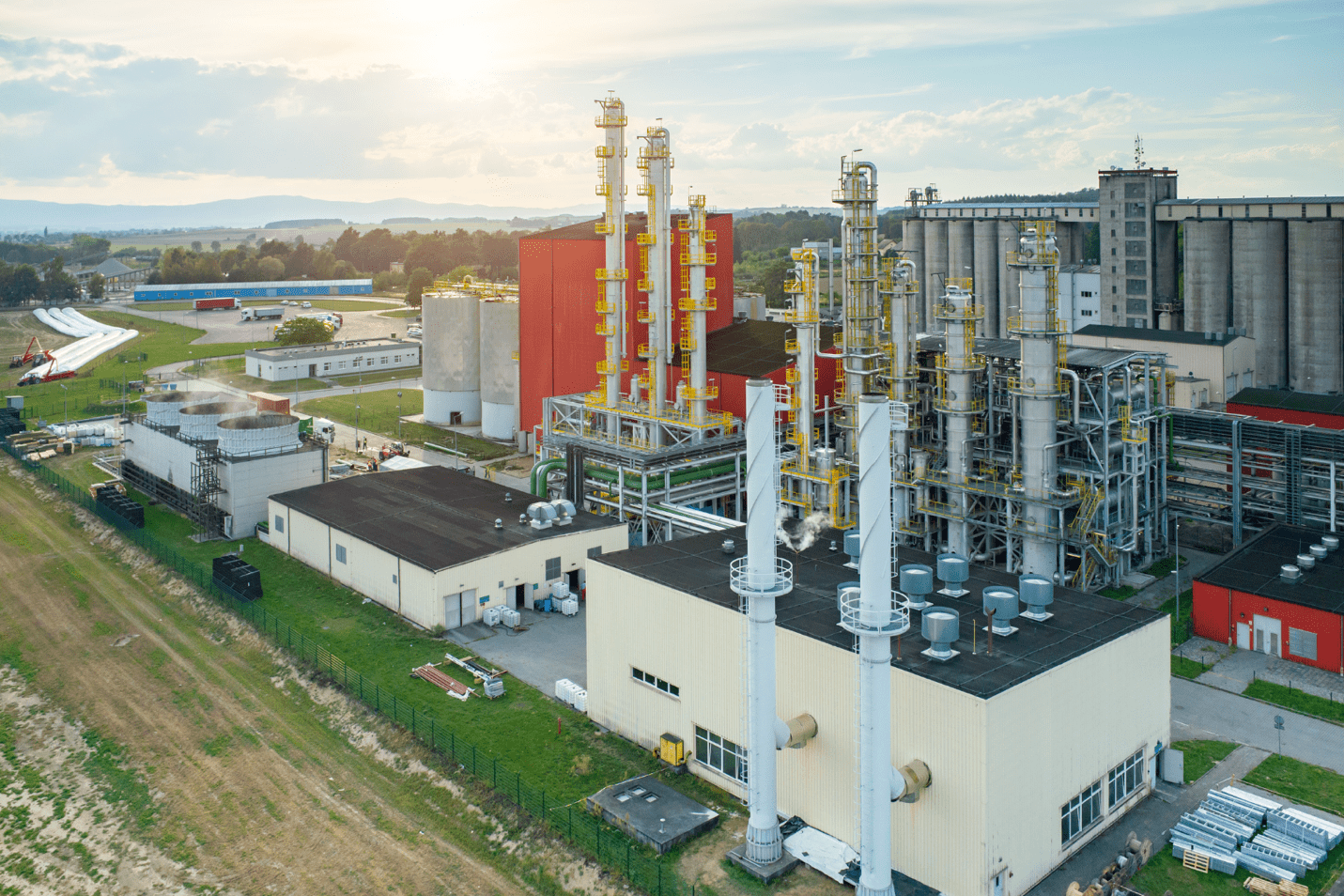

When it comes to biofuels, Brazil is a major player on the global stage. It is the world leader in ethanol production and exports and a top two producer of biodiesel. Government policy, robust local demand, and Brazil’s sizable agricultural and transportation sectors all contribute to the country’s biofuel industry.

In Brazil, the government has played a crucial role in propelling the growth of the biofuel industry. Blending rules and tax incentives are only two of the initiatives the government has put in place to encourage more widespread usage of biofuels. Brazil’s biofuel output and exports have increased because to these measures.

Brazil’s biofuel business is propelled in large part by the country’s robust domestic demand. Flex-fuel cars, which can operate on a mixture of ethanol and gasoline, make up a significant portion of Brazil’s vehicle fleet. As a result, ethanol use at home has increased. The Brazilian biofuel business is also strongly supported by the agriculture sector. The agricultural industry is well developed, and there is a lot of farmland in the nation. Because of this, Brazil has risen to prominence as a biofuels producer and exporter.

What is biofuel?

Biofuel, made from renewable resources like biomass, is a fuel source that will never run out.

Biofuel is hailed as one of the cleanest and most convenient energy sources on Earth. Biomass, such as wood and straw, are directly combusted to produce biofuels in the form of gases and liquids. Sludge, sewage, and vegetable oil matter are all examples of organic materials that may be digested and fermented to produce biofuels.

The origin and composition of biofuels are two distinguishing factors. Forest products, agricultural goods, fishery products, municipal garbage, and the by-products and wastes of the food processing and service industries are also potential sources. Fuelwood, charcoal, and wood pellets are all examples of solid biomass, whereas ethanol, biodiesel, and pyrolysis oils are all examples of liquid biomass, and biogas is an example of a gaseous biomass. There is also a difference between primary (raw) and secondary (refined) biofuels:

In the case of primary biofuels, such as firewood, wood chips, and pellets, the organic material is utilised largely in its raw state (as harvested). These fuels are burned in open flames to provide a variety of domestic and industrial energy demands, including those for cooking, heating, and generating electricity.

Charcoal, ethanol, biodiesel, and bio-oil are all examples of secondary biofuels, but there are many more, such as biogas, synthesis gas, and hydrogen, that may be used in transportation and high-temperature industrial operations.

There are several upsides of using biofuels:

- It encourages a healthier society as a whole.

- It contributes to the upkeep of a cleaner atmosphere.

- Dangerous gases including carbon monoxide (CO) and sulphur oxide (SO2) are not being released (SO).

- By switching to biofuels from fossil fuels, we cut down on harmful emissions that may cause cancer and lung difficulties.

- Since they lower the likelihood of global warming, biofuels are environmentally benign.

Brazilian biofuel market

Throughout the projection period, the Brazilian biofuel market is anticipated to grow at a CAGR (compound annual growth rate) of around 4%, with output rising from 41.18 million cubic meters in 2020 to 50.87 million cubic meters in 2027. The 2020 Brazilian biofuel sector was severely hit by the COVID-19 outbreak. The limits put in place on March 31 ahead of the sugarcane harvest on April 1 had a detrimental effect on ethanol output. Market growth for biofuels in the nation is anticipated to be stimulated by a number of macroeconomic and microeconomic factors. Yet, the market might be hampered by a decrease in feedstock availability for ethanol.

In light of the country’s large ethanol output, ethanol is the most probable candidate to dominate the biofuel market.

As it can be produced from biomass, ethanol is considered a renewable biofuel. Sugarcane, maize, and sugar beets are often fermented with yeast to produce ethanol. After the United States, which is the biggest user, producer, and exporter of ethanol worldwide, Brazil remained the world’s second-largest leader in ethanol production as of 2022. Brazil’s declining ethanol prices in 2021-2022 were even a positive sign for consumption.

Statistics from the Global Agricultural Information Network show that in 2022, overall ethanol consumption was projected to be 29.60 billion litres, while total ethanol usage as a fuel in the nation was projected to be 27.67 billion litres. Ethanol, like biodiesel, is mixed with gasoline for use in vehicles; the bioethanol standard was set at 27% as of January 2023; the most recent revision to this mandate was in 2015. Such regulations are anticipated to boost the market throughout the projected period due to the rising demand for gasoline.

Due in large part to an expansion in production capacity in the Mato Grosso and Goiasstates, Brazil’s corn-based biofuel has grown its percentage of the country’s ethanol mix in recent years. Yet severe weather and fires in 2021-2022 have hampered planting efforts and damaged sugar cane roots, which is predicted to have a detrimental influence on output over the following 2 to 3 years.

For 2020-2021, Brazil increased its maize output to 115.22 million metric tons, a 32% year-on-year increase. As maize has gained in popularity, ethanol manufacturers in the nation have sought for other sources of supply in an effort to lessen their reliance on sugarcane and external factors like weather. To lessen the need for sugarcane, numerous maize ethanol projects have been announced in recent years.

Over the forecast period and beyond, the biofuel market in the nation is likely to benefit from the growth of new and growing end-user sectors, such as power generation, aviation, and marine.

To construct a greenfield dry-mill grain ethanol production plant in Mato Grosso, Brazil, ICM and Agribrasil inked a contract in March 2022. Patented Selective Milling Technology (SMT) for milling optimisation, Base Tricanter System (BTS) for maize oil recovery, and Patented Fiber Separation Technology (FST) for fibre removal prior to fermentation are all planned to be used in the plant. Agribrasil hopes to increase its efficiency in producing ethanol and corn oil with the help of these new technology. It is anticipated that a distributed control system (DCS) would be included into the layout of the plant to facilitate the automated management of output.

After signing a supply deal with Brazil’s largest fuel distributor Vibra Energia in November 2021, Brazilian palm oil company Brasil Biofuels (BBF) revealed intentions to construct the country’s first hydrotreated vegetable oil (HVO) facility. The factory, which will produce around 500 million litres annually, will begin operations in January 2025 in the Manaus free-trade zone in the Amazonas state.

The growth of Brazil’s biofuel industry is anticipated to be driven by rising demand and use of biofuels in the transportation sector.

Brazil is a prominent player when it comes to the usage of biodiesel on a worldwide scale. Another term for biodiesel is fatty acid methyl ester, or FAME for short. Biodiesel is produced from fats and oils derived from plants and animals. According to projections made by the Petroleum, Natural Gas, and Biofuels National Agency (ANP), only around 15% of biodiesel produced in 2022 would be derived from animal fat, while the remaining 79% will be derived from soybean oil.

As of the year 2021, there are 57 biodiesel plants that have been permitted to operate in the United States, with 60% of these facilities situated in the Midwest, where there is an abundance of soybeans.

In addition, biodiesel-fuelled engines have been created as a reaction to the ever-increasing availability of biodiesel as well as the growing rate of technological breakthroughs in the automotive sector. The number of autos and trucks that are powered by biofuel in Brazil is more than in any other country in the globe. As a direct consequence of this, it is anticipated that there would be an increase in demand for heavy trucks that run on biodiesel during the duration of the projected period.

Use TradeData.Pro to explore Brazil’s biofuel market!

TradeData.Pro is an AI-powered market intelligence platform.

If you want to study the worldwide market, we can help by giving you access to online import and export statistics for more than 220 nations. Use our trade data to research new suppliers, buyers, suppliers, markets, or goods, or to keep tabs on the competition.

Import-export data can significantly help you succeed in your trade and business operations. So, subscribe to TradeData.Pro now!

The most trustable and reliable source for Trade Data.

TradeData.Pro is a reliable and trustworthy source of trade data proudly made in Singapore, a country known for its stable political climate and trade-driven economy. Presented by Commodities Intelligence Centre, a government-linked company and a joint venture of Zall Smartcom, SGX, and GeTS, TradeData.Pro has received positive feedback from the market since its launch in 2018 for its extensive coverage, affordability, and fast response. The platform has been awarded the Singapore Quality Class in 2020 and the Stevie Award Gold in 2021.

Traditionally, obtaining critical data to reveal trends, identify market opportunities, track competitors, buyers, and suppliers, and better understand the potential of the supply chain has been a challenge. However, the detailed shipment information that is part of government import and export filing requirements does exist and forms the core of global trade. TradeData.Pro has gathered and packaged this information as business intelligence, which helps companies understand the flow of goods across borders and features the world’s largest searchable trade database. TradeData.Pro reviews, standardizes, and cleans data and delivers it in an intuitive format, making it easier for businesses to access.

Businesses interested in staying updated on Vietnam, the hottest industry lately, can access all relevant information on the TradeData.Pro platform. They can find the exact product they’re interested in by checking out the trade database demo at https://tradedata.pro/asia-trade-data/vietnam-import-export-data/. To learn more about accessing new markets, visit https://tradedata.pro/trade-database-demo/.

Additionally, businesses can check out this article to learn how to use TradeData.Pro to access Global Trade Markets: https://blog.tradedata.pro/say-hello-to-our-new-release-of-tradedata-pro/. To understand how TradeData.Pro works, watch the video below or visit https://www.youtube.com/watch?v=tITfUvjs6Gc.

Brazil Business Economy Export Global Import International Trade Leads manufacturing Markets Trade Data Pro Worldwide