- Home

- Trade News

- How to do a competitor analysi ...

Vietnam’s economic development has led to rapid growth in the construction sector, whether it is for factories, warehouses, infrastructure, or residential housing. This is because increased economic activity rising the need of factories and warehouses, and rising incomes have made it easier for people to buy housing, especially high-end housing. As a result, Vietnam’s construction industry has always had good development prospects, especially in recent years have the best profit growth rate in the Asia Pacific region. You can read more details about Vietnam economy prospect here.

Although Vietnam’s construction industry is inevitably affected by the COVID-19 pandemic, this sector continues to grow along with Vietnam’s rapidly developing economy. This has therefore attracted a lot of Foreign Direct Investment (FDI).

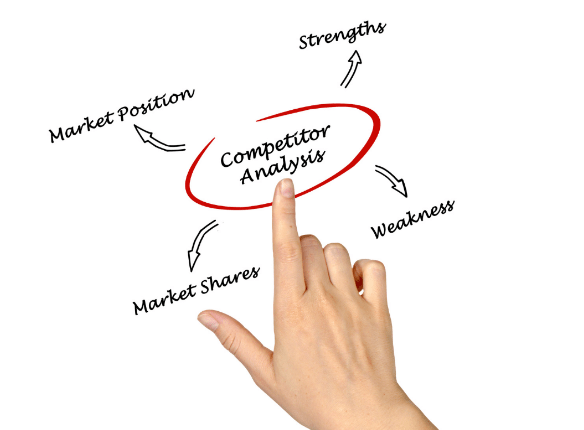

Importance of Competitor Analysis

Whether you are just entering a new market or have established a presence in this market, it is very important to analyse its competitors. For a new player who is just entering the market, understanding the market competitors through risk assessment helps you decide whether to enter the market or the way to enter the market. By using TradeData.Pro to query competitor information, you can follow up on the latest situation of competitors in real-time, especially to examine potential competitors and competitors just entering the market, so as to make corresponding countermeasures. Moreover, the information and data of competitors can also be used to analyse the trends of the industry. Therefore, a competitor analysis has become very important, especially in the Vietnam construction industry with many competitors.

How to conduct competitor analysis in Vietnam’s construction industry is very important.

Here are 5 steps to help you better conduct competitor analysis in the Vietnam construction industry.

Step 1: Identify your competitors

After collecting data from TradeData.Pro, the first step is to identify your opponent. Whether it is existing rivals or potential rivals or other foreign rivals, you must understand and classify them. You can classify your opponents as:

1. Direct competitor

Also known as a Primary Competitor. Such competitors offer the same or similar products or services to you and target the same group of consumers. For example, if you sell building stones and your main business is in Ho Chi Minh City, then other stone companies also doing business in Ho Chi Minh City will be your direct competitors.

2. Indirect competitor

The Indirect competitor, also known as Secondary Competitor, usually sells products or services that are different from yours but in the same general category.

3. Substitute competitor

The Tertiary Competitor markets the same audience but sells different products or services from your company or competes directly with your company in any way. They might also be your potential partners or competitors in the future.

The most influential and competitive direct competitor in the current Vietnamese construction industry is worth your attention. In this case, the analysis resources must focus on these competitors first. Of course, you should not ignore other competitors, and pay attention to their dynamics in real-time. Sometimes, indirect competitors or substitute competitors may also have the opportunity to become your direct competitors.

Step 2: Collect your competitors’ further information

Get your competitors’ trade data and information by searching in TradeData.Pro

After a preliminary classification of competitors, the next step is to gather more information and data. This information includes the price, features, positioning, advantages and disadvantages of competitors’ products and services, target areas, and marketing techniques. In addition, competitors’ market share percentage, suppliers, trade transactions (such as export trade transactions), and so on.

A few example questions for you when conducting the competitor analysis of the Vietnam Construction industry are as follows:

- How are competitors’ services?

- What is the market share percentage of this industry?

- Who is the competitors’ supplier?

- How about their export business?

- Are their reputations good?

TradeData.Pro provides the organised data you need and omits the heavy lifting for you by reviewing, standardising, and cleaning data, then delivering it in an intuitive format. Therefore, with just a click, you can get the information and data you need in an easier and more effective way. You can find more guidelines here to help you monitor your competitor using TradeData.Pro.

Step 3: Examine your competitors’ strengths and weaknesses

Next, a large amount of reliable data can help you evaluate the strengths and weaknesses of your competitors to understand the competitiveness of your competitors.

Step 4: Define your competitive advantages

The most important part of competitor analysis is to understand your company’s strengths. Therefore, after knowing the strengths and weaknesses of your competitors, you must make a suitable strategy by comparing your own strengths. Your own advantage can be a unique corporate culture or the idea conveyed by the brand, which attracts the attention of your target consumers and increases their favourable rating, so as to help you stand out among the many competitors.

Step 5: Make a conclusion analysis based on your competitive advantages with competitors’ advantages and disadvantages

You can better position the current situation and situation of your business by comparing your own advantages with the advantages and disadvantages of your competitors. For example, you can learn what strengths your competitors have that you don’t, and then find ways to improve or strategise against them. In addition, understand your competitors’ weaknesses by examining whether your own business is facing these problems. In another condition, you can take the chance by lowering your prices and introducing new promotions if you find the weakness of your competitor.

In conducting competitor analysis, you must not allow your competitor’s profile to dominate your strategy planning. Understanding your opponents while focusing on your own business condition is significant in competitor analysis.

How often should you conduct a competitor analysis?

Times are constantly changing and updating. This of course also leads to constant changes in various industries, so competitors need to be constantly evaluated. In addition, there may be new competitors in the industry, and if they are ignored, you may lose your odds. Especially a potential industry like Vietnam’s construction industry will surely attract new competitors to enter the market to seek opportunities. Therefore, a regular competitor analysis is key. Regularly analysing your business against your competitors will reveal opportunities to improve your products, better serve your target customers and increase profitability. You are recommended to perform the analysis annually on a large scale and quarterly on a small scale.

Conclusion

In the book “The Art of War”, Sun Tzu stated that ” If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle. ” The same theory applies to the business field. Conducting a competitor analysis helps you to grasp the situation, make a correct judgment and ensure that your enterprise will not be eliminated by the changes of The Times, or industry changes, to achieve the purpose of sustainable management.

Struggling with how to conduct competitor analysis for Vietnam’s construction? TradeData.Pro which accesses the largest database of 220+ countries, consisting of 52+ countries of import, export, and customs data may help you achieve your goal. Data in TradeData.Pro covers various countries, such as Turkey, Thailand, Vietnam, Bangladesh, Zimbabwe, and other Asia, Africa, America, Europe and Oceania countries. On the advanced search filter, you can input Importer Company Name, Exporter Company Name, Product Name, or Country of Origin information in the time period you have selected. Find your competitor’s shipment value, quantity, country of origin, port of loading, port of discharge, and destination country.

The most trustable and reliable source for Trade Data.

TradeData.Pro is a reliable and trustworthy source of trade data proudly made in Singapore, a country known for its stable political climate and trade-driven economy. Presented by Commodities Intelligence Centre, a government-linked company and a joint venture of Zall Smartcom, SGX, and GeTS, TradeData.Pro has received positive feedback from the market since its launch in 2018 for its extensive coverage, affordability, and fast response. The platform has been awarded the Singapore Quality Class in 2020 and the Stevie Award Gold in 2021.

Traditionally, obtaining critical data to reveal trends, identify market opportunities, track competitors, buyers, and suppliers, and better understand the potential of the supply chain has been a challenge. However, the detailed shipment information that is part of government import and export filing requirements does exist and forms the core of global trade. TradeData.Pro has gathered and packaged this information as business intelligence, which helps companies understand the flow of goods across borders and features the world’s largest searchable trade database. TradeData.Pro reviews, standardizes, and cleans data and delivers it in an intuitive format, making it easier for businesses to access.

Businesses interested in staying updated on Vietnam, the hottest industry lately, can access all relevant information on the TradeData.Pro platform. They can find the exact product they’re interested in by checking out the trade database demo at https://tradedata.pro/asia-trade-data/vietnam-import-export-data/. To learn more about accessing new markets, visit https://tradedata.pro/trade-database-demo/.

Additionally, businesses can check out this article to learn how to use TradeData.Pro to access Global Trade Markets: https://blog.tradedata.pro/say-hello-to-our-new-release-of-tradedata-pro/. To understand how TradeData.Pro works, watch the video below or visit https://www.youtube.com/watch?v=tITfUvjs6Gc.

Business Economy Export Global Import International Trade Markets Opportunities Supplier Trade Data Pro Vietnam Worldwide