- Home

- Trade News

- Vietnam’s First Half Tra ...

Exploring Vietnam’s Trade Trends and Key Highlights

As the world continues to navigate through economic challenges, it’s crucial to analyze the trade performance of different countries to gain insights into global market dynamics. In this regard, a preliminary assessment of Vietnam’s international merchandise trade for the first half of 2023 provides valuable information on the nation’s trade trends, key highlights, and trading partners. Let’s delve into the data to understand how Vietnam’s trade landscape has evolved over the past months.

1. Month-on-Month Growth and Trade Surplus

In June 2023, Vietnam witnessed a 3.2% increase in total external merchandise turnover compared to the previous month. This boost was primarily driven by a 5.0% increase in exports, amounting to $29.45 billion, and a 1.3% rise in imports, totaling $26.36 billion. This positive momentum resulted in a trade surplus of $3.09 billion for the month.

2. Half-Year Trade Performance

For the first half of 2023, Vietnam’s total trade-in-goods reached $316.52 billion, marking a 15.2% decrease compared to the previous year. This decline was reflected in the shrinking value of both merchandise exports and imports, which decreased by 12.0% ($164.68 billion) and 18.4% ($151.84 billion) respectively. Despite these challenges, Vietnam maintained a trade surplus of $12.84 billion for the period.

3. Foreign Direct Investment (FDI) Contribution

Trade data from Vietnam Customs unveiled the role of Foreign Direct Investment (FDI) in shaping the nation’s trade landscape. In June 2023, FDI traders accounted for a total export and import value of $38.40 billion, showing a 5.0% increase compared to the previous month. FDI exports were valued at $21.42 billion, while imports stood at $16.98 billion, resulting in a trade surplus of $4.45 billion for the month. For the January to June period, FDI traders contributed to a total trade value of $218.98 billion, experiencing a decline of 14.9% year-on-year. FDI exports reached $120.37 billion, down by 12%, while FDI imports totaled $98.62 billion, reflecting an 18.1% decrease. The cumulative FDI trade balance for this period stood at a surplus of $21.75 billion.4. Notable Export and Import Trends

The months of May and June 2023 brought about shifts in Vietnam’s export and import patterns. The growth in total merchandise exports during this period was driven by increased exports of telephones and mobile phones (up by $1.09 million), computers and electrical products (up by $591 million), and textiles and garments (up by $144 million). On a year-on-year basis, certain products contributed to the reduction in exports. Telephones and mobile phones, textiles and garments, wood and wooden products, computers and electrical products, footwear, machinery, equipment, tools, instruments, and fishery products all saw decreases in export value, contributing to an overall decline of $22.49 billion in exports to $164.68 billion.

5. Dominant Export Commodities

Trade statistics highlighted four significant commodity groups in the first half of 2023 that played a pivotal role in Vietnam’s trade performance. These were computers, electrical products, spare-parts and components thereof; machinery, equipment, tools, and instruments; telephones, mobile phones, and parts thereof; and textile, leather, and footwear materials and auxiliaries group. Notably, telephones, mobile phones, and parts thereof reached an export value of $24.2 billion, marking an 18.2% decrease year-on-year. Key trading partners for this commodity included China, the United States, the EU (27), and the Republic of Korea. Similarly, computers, electrical products, spare-parts and components, machinery, equipment, tools, and instruments, and textiles and garments each played a significant role in Vietnam’s export landscape.6. Import Trends

During the May to June 2023 period, increases in merchandise imports were observed in computers, electrical products, spare-parts and components, coal, and petroleum products. Conversely, imports for telephones, mobile phones, and parts thereof; computers, electrical products, spare-parts and components; machinery, equipment, tools, instruments; iron and steels; plastics; fabrics; chemicals; and other base metals all contributed to a reduction in imports on a year-on-year basis, leading to a total import value of $151.84 billion.

Trade data from Vietnam Customs unveiled the role of Foreign Direct Investment (FDI) in shaping the nation’s trade landscape. In June 2023, FDI traders accounted for a total export and import value of $38.40 billion, showing a 5.0% increase compared to the previous month. FDI exports were valued at $21.42 billion, while imports stood at $16.98 billion, resulting in a trade surplus of $4.45 billion for the month. For the January to June period, FDI traders contributed to a total trade value of $218.98 billion, experiencing a decline of 14.9% year-on-year. FDI exports reached $120.37 billion, down by 12%, while FDI imports totaled $98.62 billion, reflecting an 18.1% decrease. The cumulative FDI trade balance for this period stood at a surplus of $21.75 billion.4. Notable Export and Import Trends

The months of May and June 2023 brought about shifts in Vietnam’s export and import patterns. The growth in total merchandise exports during this period was driven by increased exports of telephones and mobile phones (up by $1.09 million), computers and electrical products (up by $591 million), and textiles and garments (up by $144 million). On a year-on-year basis, certain products contributed to the reduction in exports. Telephones and mobile phones, textiles and garments, wood and wooden products, computers and electrical products, footwear, machinery, equipment, tools, instruments, and fishery products all saw decreases in export value, contributing to an overall decline of $22.49 billion in exports to $164.68 billion.

5. Dominant Export Commodities

Trade statistics highlighted four significant commodity groups in the first half of 2023 that played a pivotal role in Vietnam’s trade performance. These were computers, electrical products, spare-parts and components thereof; machinery, equipment, tools, and instruments; telephones, mobile phones, and parts thereof; and textile, leather, and footwear materials and auxiliaries group. Notably, telephones, mobile phones, and parts thereof reached an export value of $24.2 billion, marking an 18.2% decrease year-on-year. Key trading partners for this commodity included China, the United States, the EU (27), and the Republic of Korea. Similarly, computers, electrical products, spare-parts and components, machinery, equipment, tools, and instruments, and textiles and garments each played a significant role in Vietnam’s export landscape.6. Import Trends

During the May to June 2023 period, increases in merchandise imports were observed in computers, electrical products, spare-parts and components, coal, and petroleum products. Conversely, imports for telephones, mobile phones, and parts thereof; computers, electrical products, spare-parts and components; machinery, equipment, tools, instruments; iron and steels; plastics; fabrics; chemicals; and other base metals all contributed to a reduction in imports on a year-on-year basis, leading to a total import value of $151.84 billion.

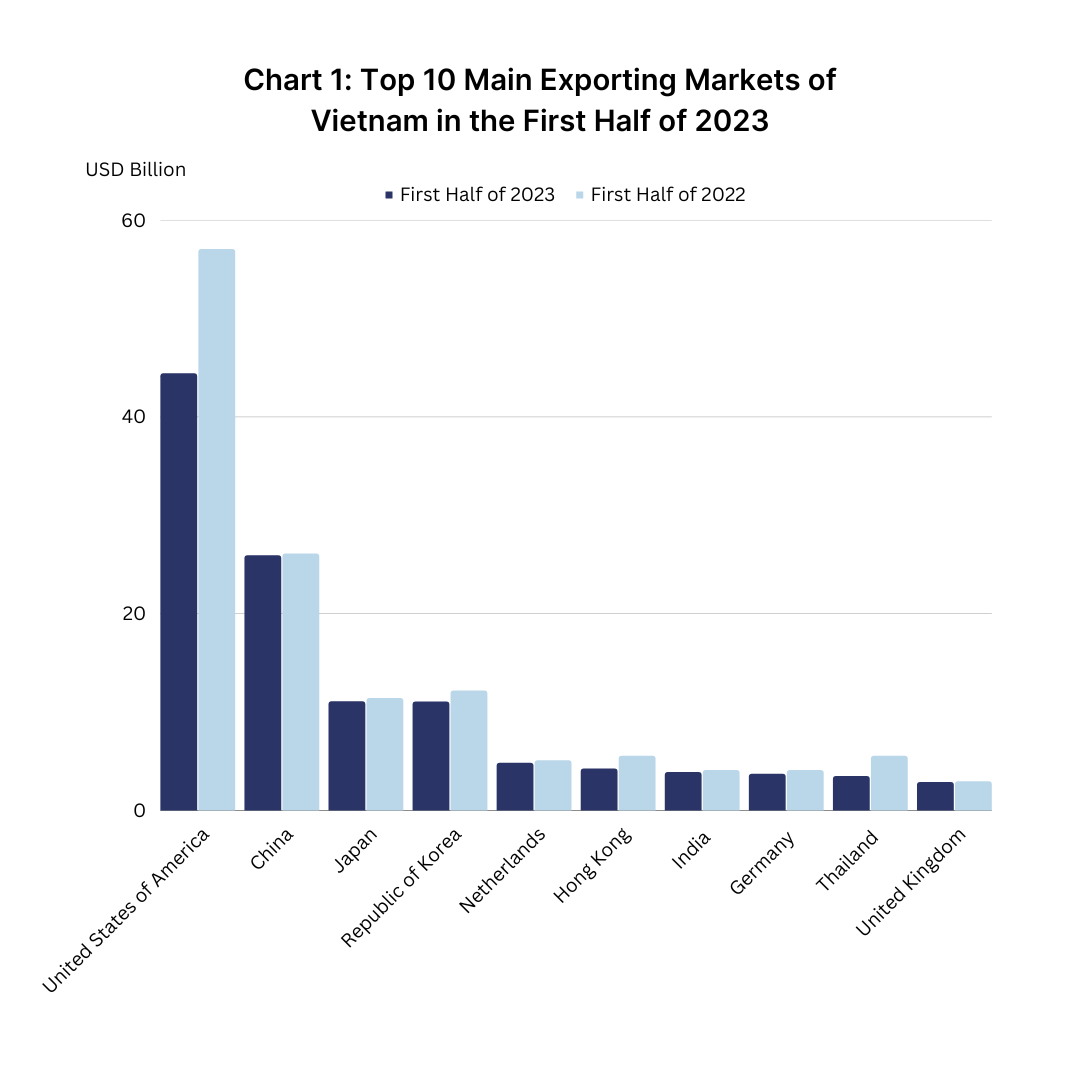

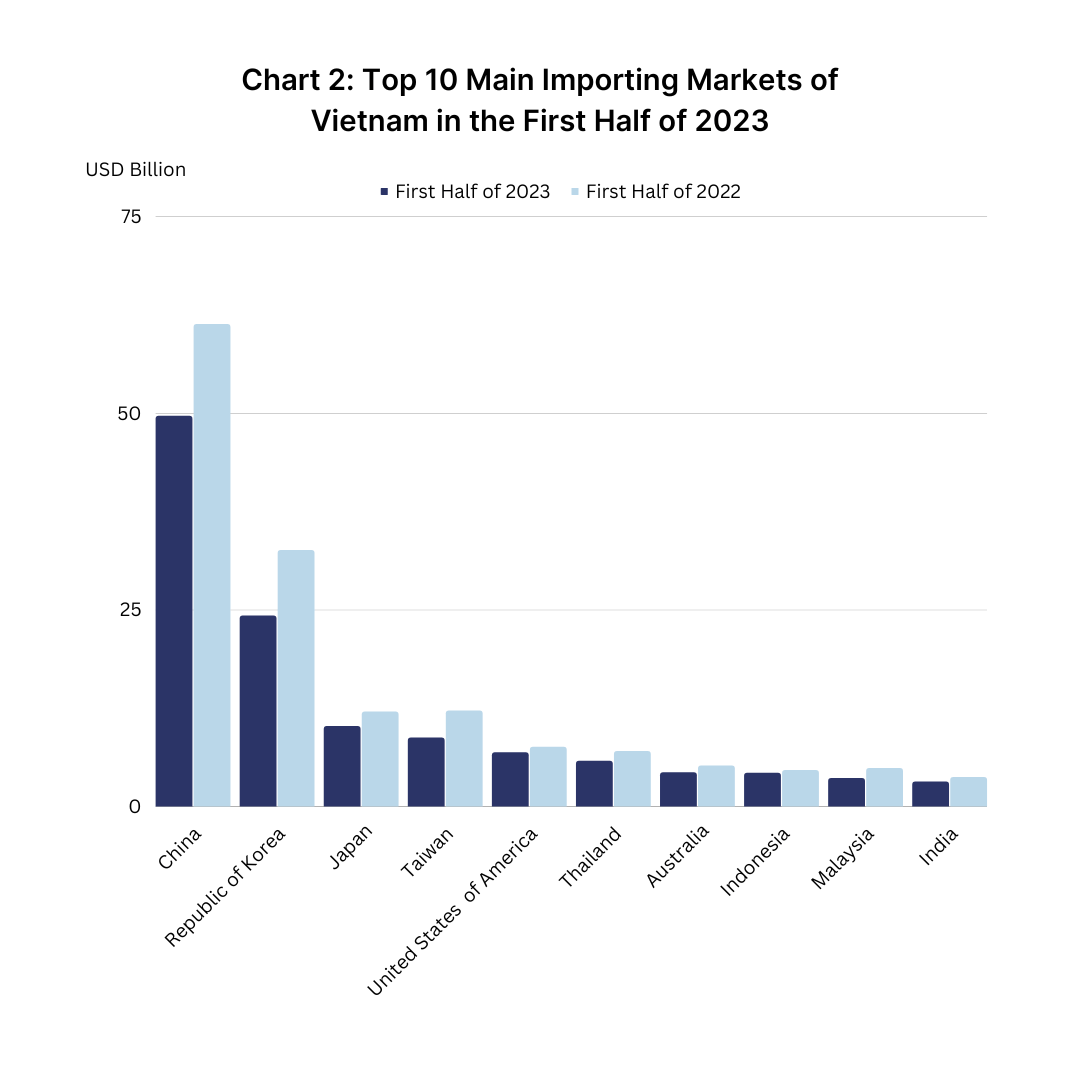

7. Top Trading Partners

Analyzing Vietnam’s trade partners further reveals interesting insights. For the January to June period, trade with Asia stood at $204.98 billion, a 14.8% decrease compared to the same period in 2022. The Americas followed with trade worth $64.29 billion, experiencing a decline of 19.9%. Europe, Oceania, and Africa also showed fluctuations in trade values during this period.

8. Major Exporting Markets

Vietnam’s major exporting markets for the first half of 2023 included the United States of America ($44.42 billion), China ($25.90 billion), Japan ($11.06 billion), and the Republic of Korea ($11.05 billion). On the import side, China ($49.65 billion), the Republic of Korea ($24.25 billion), Japan ($10.2 billion), and Taiwan ($8.74 billion) were the key partners exporting goods to Vietnam. In conclusion, the preliminary assessment of Vietnam’s international merchandise trade performance for the first half of 2023 provides a comprehensive overview of the nation’s trade dynamics. Despite the challenges posed by global economic fluctuations, Vietnam’s ability to maintain trade surpluses and adapt to changing export and import trends highlights its resilience in the face of adversity. As the year progresses, continued analysis of trade data will shed light on how Vietnam navigates its trade landscape and adapts to global economic changes.

The most trustable and reliable source for Trade Data.

TradeData.Pro is a reliable and trustworthy source of trade data proudly made in Singapore, a country known for its stable political climate and trade-driven economy. Presented by Commodities Intelligence Centre, a government-linked company and a joint venture of Zall Smartcom, SGX, and GeTS, TradeData.Pro has received positive feedback from the market since its launch in 2018 for its extensive coverage, affordability, and fast response. The platform has been awarded the Singapore Quality Class in 2020 and the Stevie Award Gold in 2021.

Traditionally, obtaining critical data to reveal trends, identify market opportunities, track competitors, buyers, and suppliers, and better understand the potential of the supply chain has been a challenge. However, the detailed shipment information that is part of government import and export filing requirements does exist and forms the core of global trade. TradeData.Pro has gathered and packaged this information as business intelligence, which helps companies understand the flow of goods across borders and features the world’s largest searchable trade database. TradeData.Pro reviews, standardizes, and cleans data and delivers it in an intuitive format, making it easier for businesses to access.

Businesses interested in staying updated on Vietnam, the hottest industry lately, can access all relevant information on the TradeData.Pro platform. They can find the exact product they’re interested in by checking out the trade database demo at https://tradedata.pro/asia-trade-data/vietnam-import-export-data/. To learn more about accessing new markets, visit https://tradedata.pro/trade-database-demo/.

Additionally, businesses can check out this article to learn how to use TradeData.Pro to access Global Trade Markets: https://blog.tradedata.pro/say-hello-to-our-new-release-of-tradedata-pro/. To understand how TradeData.Pro works, watch the video below or visit https://www.youtube.com/watch?v=tITfUvjs6Gc.

Business Economy Export Global Import International Trade Markets Opportunities Supplier Trade Data Pro Vietnam Worldwide