- Home

- Trade News

- Overcoming Common Challenges I ...

Every day, enormous amounts of trade data are produced, posing organisations with a never-ending issue of trade data analysis. For instance, Statista forecasts that the amount of data generated will continue to rise, reaching 90 zettabytes by 2022 and doubling by 2025.

Trade data analytics is crucial for making decisions. This helps improve decision-making, increase accountability, promote financial condition, and assess supply and demand for particular commodities in particular countries. However, obtaining these advantages is more difficult than it sounds. The process of gathering and using trade data is not that easy.

Here are the common challenges you might face in trade data analysis.

- Lack of competent employees with experience in trade data analytics

When a lot of trade data is produced every minute, it is critical to evaluate the various trade data. Opportunities for data scientists and data analysts are growing exponentially as a result of the enormous amount of trade data being generated. Employing a trade data analyst with multidisciplinary skills, an understanding of trade data evaluation, and the ability to work on velocity, variety, and amount of data, technologies, and business operations is vital for organisations with restricted budgets. Other than employing a data analyst, companies can also implement AI-powered trade data analysis tools to reduce costs and it will bring you an enormous advantage than you imagine.

- Gain meaningful trade data

Gather and analyse meaningful trade data

The amount of trade data that is readily available to organisations makes it difficult to gather accurate information. Employees should spend a lot of time analysing the trade data to gain insights, but this can be overwhelming. Additionally, it is impossible to organise and analyse all the trade data in real time, which could result in results that are not accurate or relevant.

Using the right trade data analytics technology, you can quickly solve this issue. You can gather, examine, and get real-time reports from the tool to make smarter decisions. Additionally, it shortens the amount of time employees spend gathering and analysing data, thereby increasing productivity. For example, we can make business relations for in-depth trade data analysis with a trade data analytics tool which can help you visualise a company’s suppliers and buyers. Along with the usage of trade data analytics technologies, employees should receive coaching sessions or online training programs on how to use data effectively.

- Data Retrieval and Storage

Data storage

Businesses are producing a lot of data because of the numerous company activities and sectors, and this amount will continue to rise. Data lakes and data warehouses that can store, analyse, and retrieve data whenever needed are needed due to the importance of data storage and accessibility. The real problem occurs when a data lake or warehouse attempts to combine inconsistent and unstructured data from numerous sources and runs into problems.

Next, we’ll look at the top three trade data analysis challenges faced by the experts.

- Data Quality

One of the typical problems of companies dealing with trade data is poor data quality. The trade data may be unstructured, have different formats, contain duplicate records, and so on. Modern technology and AI are essential for data-driven organisations to maximise the value of their trade data assets but data quality problems always frustrate them. Trade data that is incorrect or incomplete, security issues, hidden data—the list goes on and on. Numerous surveys demonstrate the scope of financial losses caused by trade data quality issues across numerous industries. Lower-income and increased operating costs, both of which result in financial loss, are direct effects of poor trade data quality. The organisational efforts in governance and compliance are substantially influenced by data quality too, which causes additional rework and delay.

These data difficulties can be resolved in a number of ways. Practice data consolidation is the first strategy. In this situation, you create a database of important information that serves as a “single source of truth.” The next step is to establish a data directory where all of the records will be organised and sorted. You can get rid of duplicates in this situation. It goes without saying that this transformation of enormous volumes of data must occur slowly, thus it’s critical to identify the data that is most utilised and crucial to your company but with TradeData.Pro, you can have all the cleaned data on our platform presented in an easy-to-use interface. All the trade data is clearly sorted into different columns and are organised neatly for you.

- Incorrect Data Integration

However, improper trade data integration can also have detrimental effects. For instance, data leakage or desynchronization may happen when various departments of a business employ various software and hardware solutions. Furthermore, not all solutions can be integrated end-to-end, making the structure of a trade data system needlessly complex and costly to manage.

Additionally, the objectives of businesses and the needs of their customers change along with the advancement of digital technology. This implies that they must be up-to-date which means that some of them that were relevant yesterday may already be out of date from the perspective of trade data analytics challenges. Moreover, the COVID-19 pandemic, which substantially altered user behaviour patterns, causes the relevance issue. This implies that you can no longer rely on previous data analytics for trade data analysis.

These data problems actually originate from the requirement for a tool that would offer up-to-date filtering of irrelevant data, trend analysis and reduce the processing time for new data, allowing innovations to be executed as fast as possible.

Deep automation, individual subsystem integration via an API, and the rejection of manual system control are the answers to these data issues. It’s possible that artificial intelligence may be used, which will be able to handle the processing and analysis of new unstructured information flows. The expenditures of this modernisation will be high, but in the long run, the chance of the above issues will be reduced. Don’t forget to thoroughly analyse the data you already have in order to filter out any useless information.

- Lack of expertise in data interpretation

Despite the fact that the idea of trade data analysis is nothing new, there is currently a greater need for employees with these skills than existing specialists. First and foremost, the trends in all things related to trade data can be used to explain this. As a result, many businesses work to adopt these cutting-edge solutions as soon as they can in an effort to stay ahead of competitors and dominate their respective markets.

Trade data analysis is still a challenging area to handle in practice since it requires using advanced equipment and technology. Because of this, there won’t be an oversupply of jobs in the data sector any time soon.

You’ll probably be confused not just by the need to find talent “on the side,” but also by the problem of employee training. After all, it will be considerably more economical to move some IT department specialists to new roles and then fill the resulting vacancies with new specialists rather than hiring individuals who have no prior knowledge of the work processes used in your company.

What’s the strategy for overcoming these challenges?

To effectively address the top three challenges associated with analysing trade data, big corporations typically enlist the expertise of international trade professionals who can utilise data cleaning tools to analyse large volumes of trade data. However, it is particularly challenging for industry niches, that demand specialised knowledge (e.g. electronic equipment sectors), to engage high-level specialists who can leverage the deployment of big data-based systems or tools for strategy planning and decision making. This is where AI-powered trade data analysis tools can bring the most benefits. Today, dozens of machine learning-based products are prepared to support trade data analysis. There are several trade data tools that can offer beyond data cleaning and perform trade data analysis. These platforms leverage advanced algorithms and machine learning techniques to identify patterns, trends, and insights into data that would be challenging or time-consuming for humans to do manually. With the help of AI-powered data platforms, businesses and organisations can gain a deeper understanding of their data, make data-driven decisions, and ultimately, improve their performance and outcomes.

How to be at the top of the trade data-analysing game?

The success of an AI-powered trade data platform depends heavily on the quality of its underlying trade dataset. In order to train accurate and effective AI models, the data used to train those models must be reliable, accurate, and representative of the problem being solved. Without a solid foundation of high-quality data, any AI models trained on that data will be flawed and produce unreliable results. A good example of such AI-powered trade data platform is the Singapore-made TradeData.Pro , which has leveraged 2 billion pieces of data covering over 100 countries collected from each country’s customs bureau, well-known shipping companies and authoritative data providers. Through the platform, you can get comprehensive trade information such as customs data, shipping data, company information and financial data and use the built-in features to filter and analyse the data you’re interested in.

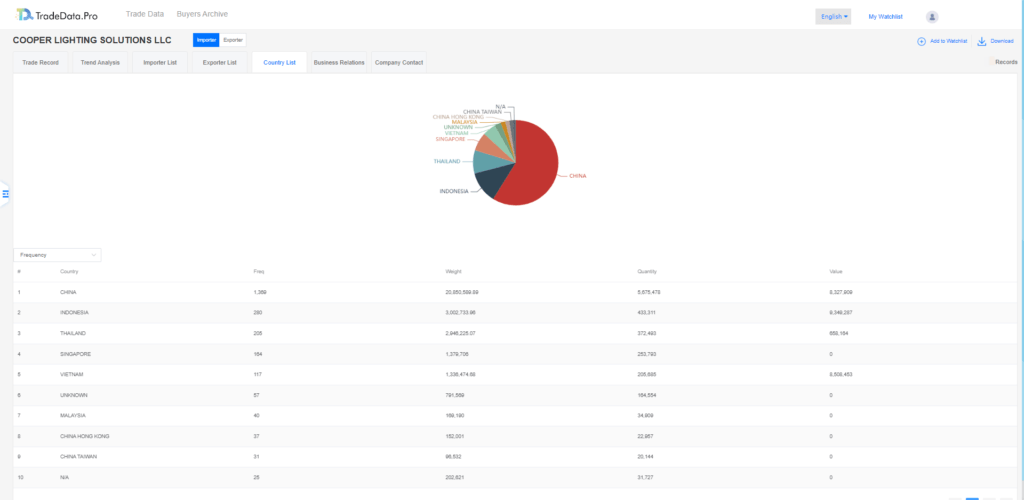

TradeData.Pro’s analysis breaks down the countries that a specific company imports from and the value/volume imported

Conclusion

Despite the fact that the idea of trade data analysis has been around for a while, many businesses pay insufficient attention to the typical problems that may be avoided when deploying trade data solutions in the beginning. As a result, this results in a considerable increase in the cost of deploying trade data analysis software and hardware solutions that enable their viability, as well as the requirement for a continuous rise in the number of human resources involved in the system’s operational operations, and other trade data challenges.

In order to avoid all of the trade data analysis problems, we highly recommend you examine your solution and, if there are any, identify the problems mentioned above. If you are considering employing an AI-powered trade data analysis tool to gain the latest insights on the import and export data, you can get them easily through TradeData.Pro. TradeData.Pro provides you with customs data such as the HS Code, importers, and exporters in any country. From there, you may gain insight into potential suppliers and buyers and make informed decisions for your business.

A reliable source of import-export data is crucial for you to get the correct market information. With trade data platforms such as TradeData.Pro, you will not only be able to access reliable data, but you can even find your potential customers, competitors, and suppliers too. This information enables you to be sustainable in a business by making strategic planning and wise decisions.

TradeData.Pro has provided its profession for over 500 companies, and you can benefit from them too. You can get in contact with your potential customers simply through TradeData.Pro. TradeData.Pro provides you with trade records, including the company names, addresses, and previous import and export records, allowing you to connect with high-potential leads and potential suppliers. Meanwhile, you may learn about how to access global trade markets by using TradeData.Pro. Contact us to gain market insight.